food tax in massachusetts calculator

The tax is 625 of the sales price of the meal. Free calculator to find the sales tax amountrate before tax price and after-tax price.

Average Local State Sales Tax.

. After a few seconds you will be provided with a full. Sales Tax State Local Sales Tax on Food. Also check the sales tax rates in different states of the US.

How is meal tax. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Maximum Possible Sales Tax. This calculator is detailed and is designed for advocates or others familiar with Excel and the SNAP rules. Your average tax rate is 1198 and your.

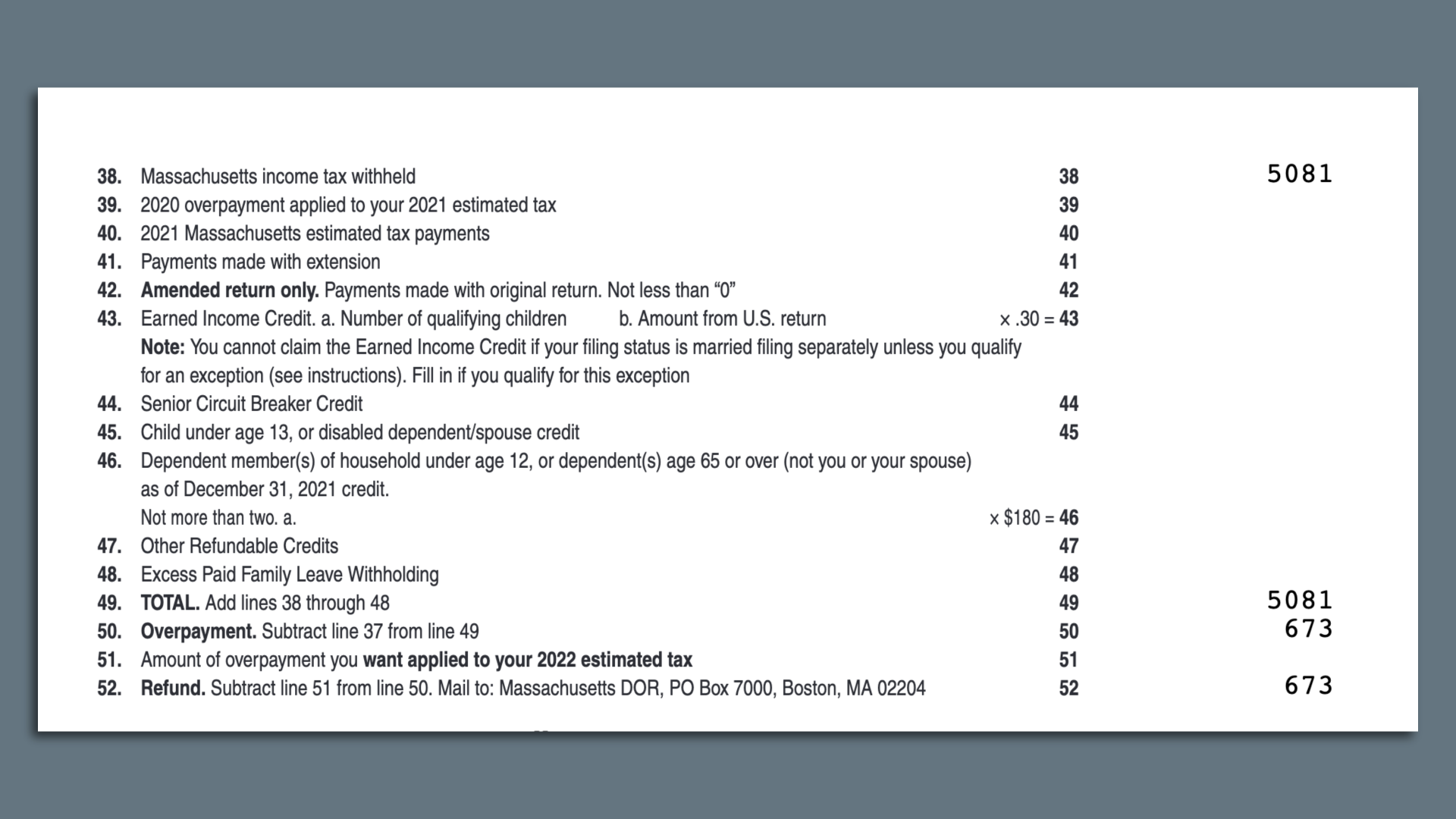

Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. Hotel rooms state tax rate is 57 845 in Boston Cambridge.

Massachusetts has a 625 statewide sales tax rate and does not allow local. The most populous county in Massachusetts. Maximum Local Sales Tax.

There should not be any additional sales tax on any local level. The Massachusetts income tax rate. Delaware Sales Tax Exemption Certificate Unlike a Value Added Tax VAT.

Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625. Massachusetts has a 625 statewide sales tax rate. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Massachusetts State Sales Tax. Overview of Massachusetts Taxes. This page describes the taxability of.

How is meal tax. The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications services 1 sold or. A local option meals tax of 075 may be applied.

The base state sales tax rate in Massachusetts is 625. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The OR sales tax applicable to the sale of cars boats and real estate sales may also vary by jurisdiction.

Massachusetts Income Tax Calculator 2021. Sales Tax Calculator 54 rows Free calculator to find the sales. The meals tax rate is 625.

The tax is 625 of the sales price of the meal. And all states differ in their enforcement of. The most significant taxes in Massachusetts are the sales and income taxes both of which consist of a flat rate paid by residents statewide.

Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. That goes for both earned income wages salary commissions and unearned income.

A 625 state meals tax is applied to restaurant and take-out meals. 15-20 depending on the distance total price etc. The base level state sales tax rate in the state of Massachusetts is 625.

Calculating your Massachusetts state income tax is similar to the steps we listed on our Federal paycheck. Massachusetts is a flat tax state that charges a tax rate of 500.

How To Calculate Sales Tax And Avoid Audits Article

Self Employed Tax Calculator Buy Now Hotsell 52 Off Smart Omega Com

Tax Calculators And Forms Current And Previous Tax Years

Sales Tax Massachusetts Taxpayers Foundation

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

Massachusetts Sales Tax Calculator Reverse Sales Dremployee

Tip Tax Calculator Payroll For Tipped Employees Onpay

The Ultimate Guide To Ecommerce Sales Tax In 2022

Mortgage Calculator Massachusetts New American Funding

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Amazon Sales Tax What It Is How To Calculate Tax For Fba Sellers

Calculator How Much Would You Pay Under The Millionaires Tax The Boston Globe

How To Calculate Sales Tax And Avoid Audits Article

Half A Million Workers Are Automatically Eligible For New 500 Stimulus Check See The Exact Date You Ll Get The Cash The Us Sun

2022 Tax Return How To Factor In Your Child Tax Credit And Covid Costs Npr

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Marijuana Tax Rates A State By State Guide Leafly

Massachusetts Income Tax H R Block

Texas Food Stamp Calculator How To Determine Snap Eligibility